Understanding the Importance of Car Insurance Mandatory for Every Driver

Understanding the Importance of Car Insurance Mandatory for Every Driver

An exploration into the realm of protective measures for vehicles often leaves individuals pondering the true necessity of such safeguards. With a myriad of choices available, the significance of these protective options merits thorough consideration. Various factors shape this discussion, including the financial implications of unforeseen events and the peace of mind that comes from adequate preparedness.

Factors such as local regulations, personal circumstances, and risk assessment play pivotal roles in determining the level of coverage deemed suitable for each individual. The balance between potential financial exposure and investment in protection will vary from person to person. Therefore, grasping the intricacies of these protective options becomes paramount in making an informed decision.

Ultimately, the choice regarding whether to embrace such options transcends mere obligation; it invites contemplation about financial security and personal responsibility. Engaging in a thoughtful analysis of one’s specific situation can illuminate the path to an informed decision, harmonizing both personal preferences and external requirements.

Understanding the Basics of Car Insurance

This section aims to clarify fundamental concepts surrounding automotive protection policies. Grasping the core principles can empower individuals to make informed choices for their financial security and legal compliance while operating vehicles.

Automotive protection serves as a financial safeguard against unforeseen incidents, such as collisions, theft, or property damage. It involves various components that cater to different needs, ensuring that drivers are not left vulnerable in challenging situations.

Several policy types exist, each designed to address specific circumstances. For instance, liability coverage provides support in instances where the policyholder is deemed responsible for damages to another party. In contrast, comprehensive protection offers assistance for non-collision-related events, including theft or natural disasters.

Understanding the various provisions and options available is essential. Factors such as state regulations, personal driving habits, and vehicle type all influence the choice of coverage. By familiarizing oneself with these elements, individuals can choose the most suitable plan for their unique situations.

Furthermore, it is crucial to consider the financial implications of these policies. Premiums, deductibles, and potential payouts can vary significantly, impacting overall affordability. Carefully evaluating these aspects can lead to better decision-making and long-term financial health.

Benefits of Having Coverage for Your Vehicle

Having appropriate protection for a vehicle brings numerous advantages that extend beyond mere compliance with legal requirements. It serves as a safety net, offering financial security and peace of mind in unpredictable situations on the road.

Firstly, such coverage mitigates the financial burden associated with accidents, theft, or natural disasters. In the event of an unforeseen incident, costs for repairs or replacements can escalate quickly. Comprehensive protection can cover these expenses, preserving personal finances.

Additionally, this form of safeguarding offers liability protection, which is crucial for safeguarding against potential claims made by other parties involved in an accident. This aspect is vital for maintaining one’s financial well-being and avoiding excessive out-of-pocket expenses in case of disputes.

Moreover, many policies include coverage for medical expenses resulting from accidents. This can alleviate the financial strain of hospital bills and treatment costs, ensuring quicker recovery without the added pressure of financial instability.

Furthermore, having a reliable plan can enhance the overall ownership experience. It fosters confidence when driving, as there is reassurance that potential damages or liabilities are adequately managed. This sense of security can transform everyday travel into a more enjoyable experience.

Lastly, in some instances, carrying appropriate protection may even lead to discounts on premiums for other types of policies. A comprehensive approach to safeguarding assets can yield overall savings, making it a pragmatic choice for many individuals.

Legal Requirements for Auto Insurance

Understanding the regulations surrounding coverage for vehicles is crucial for maintaining compliance and safeguarding against potential liabilities. Different jurisdictions impose various mandates that travelers must adhere to in order to operate a motor vehicle legally.

Key aspects of these regulations often include:

- Minimum coverage levels that must be maintained.

- Proof of financial responsibility when operating a vehicle.

- Specific penalties for non-compliance.

Depending on the state or country, requirements may vary significantly. Commonly, mandatory coverage types include:

- Bodily injury liability – covers injuries to others in an accident.

- Property damage liability – covers damage to another person’s property.

- Personal injury protection – provides medical expenses for the policyholder and passengers.

Failure to adhere to these legal obligations can result in severe repercussions such as fines, license suspension, or even imprisonment. It is essential for individuals to familiarize themselves with the specific requisites in their area to avoid such consequences.

Common Types of Insurance Policies Explained

Understanding various types of policies is essential for making informed decisions regarding protection against potential risks. Each policy type serves distinct purposes and offers varying degrees of coverage based on individual circumstances and preferences.

1. Liability Coverage

This type of policy provides financial protection against claims resulting from injuries and damages to other people or their property. It is crucial for safeguarding personal assets and ensuring compliance with local regulations.

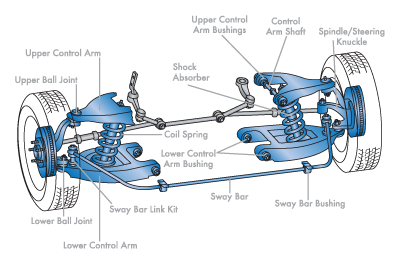

2. Collision and Comprehensive Coverage

These policies focus on safeguarding the policyholder’s own vehicle. Collision coverage addresses damages from accidents involving another vehicle, while comprehensive coverage deals with non-collision incidents, such as theft, vandalism, or natural disasters.

| Policy Type | Purpose | Coverage |

|---|---|---|

| Liability Coverage | Protection from claims | Injuries and property damage to others |

| Collision Coverage | Vehicle damage from accidents | Damages to the policyholder’s own vehicle |

| Comprehensive Coverage | Protection from non-collision events | Theft, vandalism, natural disasters |

Factors Affecting Your Insurance Rates

The cost of coverage is influenced by a myriad of elements that vary from one individual to another. Understanding these determinants can provide valuable insights into how premiums are calculated and what aspects can be adjusted to achieve potential savings.

Driving Record: A clean driving history often results in lower premiums. Alternatively, a record filled with accidents or traffic violations may lead to increased costs. Insurers closely assess the risk associated with a driver’s behavior on the road.

Location: Geographic area plays a significant role in determining expenses. Urban regions with higher traffic densities and elevated crime rates typically incur higher charges compared to rural areas, where risks are diminished.

Vehicle Type: The specific model and make of the vehicle can dramatically impact rates. High-performance cars or those with advanced technology often demand elevated premiums due to their repair costs and increased likelihood of theft.

Age and Gender: Statistical analyses reveal variations in risk based on age and gender. Younger individuals, particularly males, are often viewed as higher risk, resulting in elevated premiums compared to older, more experienced drivers.

Coverage Options: The extent of protection selected directly affects costs. Comprehensive plans with extensive coverage features come with higher premiums, while basic policies typically offer more affordable options.

Credit Score: In many regions, insurers consider credit history as an indicator of responsibility. A higher credit score may correlate with lower rates, while poor credit can lead to increased costs.

Deductible Amount: Choosing a higher deductible can lower monthly premiums. However, it’s essential to assess one’s financial ability to pay that amount in the event of a claim.

In conclusion, multiple factors intertwine to shape the landscape of premium rates. By gaining a comprehensive understanding of these elements, individuals can make informed decisions that align with their financial goals and drive responsibly.

How to Choose the Right Policy

Selecting an appropriate plan involves careful consideration of various factors that will align with personal circumstances and requirements. Conducting thorough research is essential for making informed decisions, ensuring that the chosen coverage offers adequate protection while remaining within budgetary constraints.

Identifying specific needs is paramount. Evaluating driving habits, potential risks, and the type of vehicle owned provides a clearer picture of what level of protection is necessary. Additionally, weigh the benefits of various features, such as roadside assistance or rental vehicle reimbursement, to tailor the plan effectively.

Comparative analysis is another vital step. Gathering quotes from multiple providers allows for an assessment of coverage options and pricing structures. This also aids in identifying any hidden fees or exclusions that may impact the overall value of the policy.

Understanding the terms of coverage is crucial. Familiarizing oneself with key concepts such as deductibles, liability limits, and exclusions can help in selecting an arrangement that not only meets requirements but also provides peace of mind.

Consulting experts in the field can further enhance the decision-making process. Insurance agents or brokers possess the knowledge necessary to guide individuals through the intricacies of various options, ensuring a more tailored approach to securing a suitable plan.

Q&A: Do you need car insurance

What is liability insurance and why is it important for drivers?

Liability insurance is a type of car insurance that covers damages to other people’s property or injuries they sustain in an accident where you are at fault. It is important because it protects you from financial loss due to claims made against you after an accident.

What happens if I drive without insurance in New Hampshire?

In New Hampshire, while it is not mandatory to have insurance, if you drive without insurance and are involved in an accident, you may face significant financial liability. You could be required to pay for damages out of pocket, which can be substantial.

Are there any insurance requirements for drivers in New Hampshire?

New Hampshire does not require drivers to have liability insurance, but if you choose to drive without insurance, you must demonstrate that you can cover any damages resulting from an accident. It’s advisable to have at least minimum liability coverage to protect yourself financially.

What is the minimum liability coverage required in New Hampshire?

New Hampshire does not have a statutory minimum liability coverage requirement, but it is recommended that drivers carry liability insurance to protect themselves from financial loss in case of an accident.

Can I legally drive without insurance in New Hampshire?

Yes, you can legally drive without insurance in New Hampshire, but it is risky. If you are involved in an accident and do not have insurance, you will be personally responsible for any damages or injuries caused.

What are the consequences of being uninsured after an accident?

If you are uninsured after an accident, you may face legal penalties, including fines and potential lawsuits from injured parties. You will also be responsible for paying for any damages or medical expenses out of pocket.

How can I find affordable insurance coverage in New Hampshire?

To find affordable insurance coverage in New Hampshire, compare quotes from multiple insurance providers, consider factors such as your driving history and the type of vehicle you own. Additionally, look for discounts that may apply to your situation.

Is it possible to get insurance coverage if I have a history of being uninsured?

Yes, it is possible to get insurance coverage even if you have a history of being uninsured. However, insurers may charge higher premiums due to the perceived risk. Shopping around and improving your driving record can help lower costs.

What should I do if I am involved in an accident while driving without insurance?

If you are involved in an accident while driving without insurance, gather all necessary information from the scene, including witnesses and police reports. You should also consult with a legal professional to understand your rights and obligations regarding potential liabilities.

How does driving without insurance affect my ability to get future insurance coverage?

Driving without insurance can negatively affect your ability to obtain future insurance coverage. Insurers may view you as a higher risk, leading to increased premiums or difficulty finding coverage. It’s essential to maintain continuous coverage to build a better profile with insurers.

What is the minimum liability insurance required by law in most states?

The minimum liability insurance required by law in most states typically includes coverage for bodily injury and property damage. This ensures that drivers can cover the costs associated with damage and injuries they cause in an accident.

What happens if you don’t have car insurance and get into an accident?

If you don’t have car insurance and get into an accident, you may be held personally liable for all damages and medical bills. This can lead to significant financial consequences, including lawsuits and potential loss of your driver’s license.

Why is proof of insurance necessary when buying a car?

Proof of insurance is necessary when buying a car because it demonstrates that you have the required insurance coverage to legally drive the vehicle. Most dealerships will require you to show proof of insurance before completing the sale.

What are the car insurance requirements in New Hampshire and Virginia?

In New Hampshire and Virginia, car insurance requirements differ from most states. While New Hampshire does not mandate insurance, it requires drivers to demonstrate financial responsibility. Virginia requires drivers to either carry auto insurance or pay a fee for uninsured motorist coverage.

How does driving without car insurance affect your ability to get affordable insurance later?

Driving without car insurance can negatively impact your ability to get affordable insurance later because insurers may view you as a higher risk. This can lead to increased premiums and difficulty obtaining coverage in the future.

What are the consequences of being caught driving without insurance?

If you’re caught driving without insurance, you may face penalties such as fines, points on your driver’s license, and possible suspension of your license. Additionally, you may be required to show proof of insurance before being allowed to drive again.

What should you do if you need to file a claim but don’t have insurance?

If you need to file a claim but don’t have insurance, you’ll be responsible for covering all costs out of pocket. It’s advisable to seek legal advice to understand your options and obligations regarding potential damages and liabilities.

What type of car insurance coverage is usually required by law?

The type of car insurance coverage usually required by law includes minimum liability coverage for bodily injury and property damage. This ensures that drivers have enough insurance to cover damages and medical expenses resulting from accidents.

How can comprehensive and collision coverage benefit drivers?

Comprehensive and collision coverage can benefit drivers by providing protection against a wide range of risks, including theft, vandalism, and damage from accidents. This additional coverage helps ensure that drivers are financially protected in various situations.

What happens if you buy a car but don’t have adequate insurance coverage?

If you buy a car but don’t have adequate insurance coverage, you may face legal issues, including fines and penalties for not meeting your state’s minimum insurance requirements. Additionally, you could be liable for any damages or injuries in the event of an accident.